Mining DB1B: The Dynamic Relationship Between Ticket Price and Economic Indicators

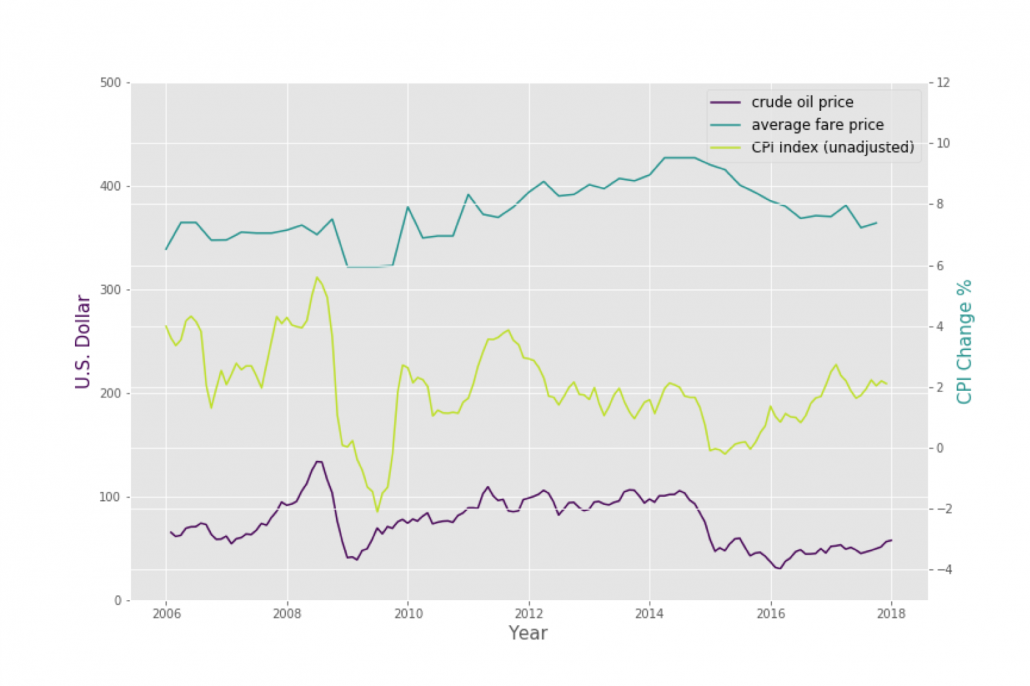

In this post, we study the relationship between airline ticket price and some economic indicators. The goal is trying to find how the changes in certain economic indicators will affect the ticket price. We will analyze the annual average flight price in the U.S. between 2006 and 2017 using a side by side comparison with the Consumer Price Index (CPI) and crude oil price during the same time window.

This figure illustrates the relationship between crude oil price, inflation (CPI) and airline industry cost/price (annual average fare). As oil prices move up or down, inflation follows in the same direction. The reason why this happens is that oil is a major input in the economy – it is used in critical activities such as fueling transportation and heating homes – and if input costs rise, so should the cost of end products. For example, if the price of oil rises, then it will cost more to make aviation fuel, and an airline company will then pass on some or all of this cost to the consumer, which raises prices and thus inflation.

For more details about the dataset, visit the following page