Mining DB1B: A Performance Comparison Between Low-Cost and Full-Service Airlines

In recent years, the rise of low-cost airlines has attracted a huge number of travelers from traditional ‘legacy’ airlines. In this blog post, we will compare the market share distribution and revenue generating capability of the top airlines.

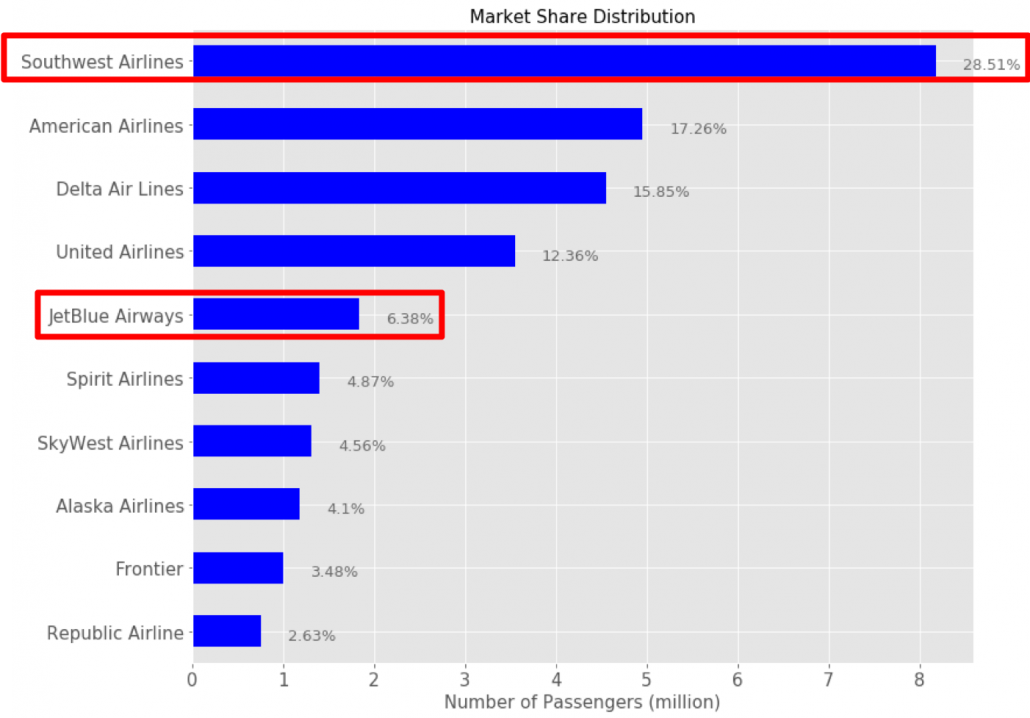

We can examine the distribution of the passengers in the year 2017 by respective reporting carrier and their percentage (figure below). We note that the top 5 largest reporting airlines (in terms of the number of passengers) consist of two low-cost carriers: Southwest, and Skywest and the 3 legacy carriers: Delta, American Airline, and United Airline.

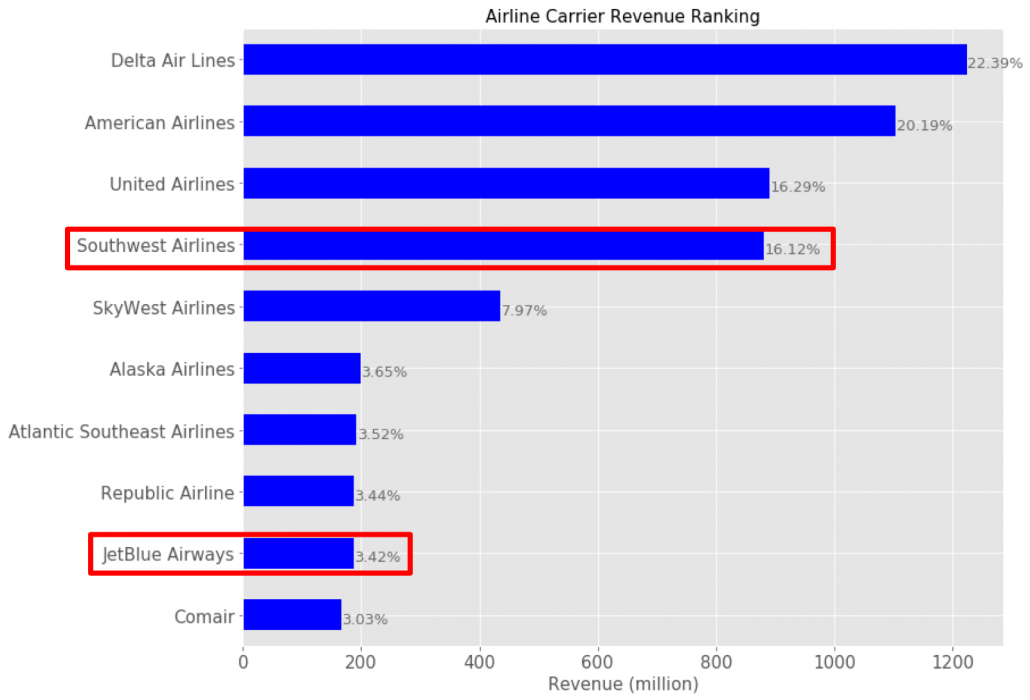

However, if we take look at the revenue ranking (figure below) at the same time windows, the two major low-cost carriers have shown weaker revenue-generating capability.

Based on the above observation, we can draw some interesting conclusion: although low-cost airlines could attract more travelers by offering lower itinerary price, the increased market share does not generate enough revenues to compete with the regular, full-service airlines.

For more details about the dataset, visit the following page